Building a Daily Routine for Effective Stock Market Analysis

Published: 2025-03-25 Edited By: Asai Andrade

1. Start with the Fundamentals: Technical Analysis Every Morning

Before diving into trading, it's essential to start your day with solid technical analysis. This means reviewing stock charts, identifying key levels of support and resistance, and taking note of any indicators such as RSI, MACD, or moving averages that are flashing signals.

You don't need to be a pro to spot patterns. Resources like Technical Analysis for Dummies or the Evidence-Based Technical Analysis PDF are great morning reads to sharpen your eye and learn how experienced traders interpret patterns. These quick reads can train your brain to catch market signals faster.

Whether you're checking the S&P 500 technical analysis or exploring lite coin technical analysis out of curiosity, dedicating 15-20 minutes in the morning to analysis sets a focused tone for the rest of the day.

Make It Visual

Visual learners benefit from using candlestick charts or charting tools like TradingView. Keep an eye on consistent formations—bull flags, triangles, and double tops—because recognizing these will help you react faster once the market opens.

Stock technical analysis becomes much more intuitive when you build a habit of identifying patterns and confirming your insights with evidence-based technical indicators.

2. Chart Reviews & Setup: Building Consistency with Stock Technical Analysis

Every morning, after your initial chart review, it's time to get into setup mode. Stock technical analysis isn't just about finding patterns—it's about preparing for action. Review your watchlist, check volume trends, and analyze recent movements in your target stocks.

Set alerts for breakouts, trend reversals, or divergences. These can be based on price levels, RSI thresholds, or specific moving average crossovers. Creating a repeatable process helps filter the noise and narrows your focus on only the most actionable setups.

If you're using a trading simulator or practicing stock trading with fake money, this is a perfect time to test your routines in a low-risk environment. Even if it's just 15 minutes a day, that repetition builds long-term skill.

Practical Tools to Use

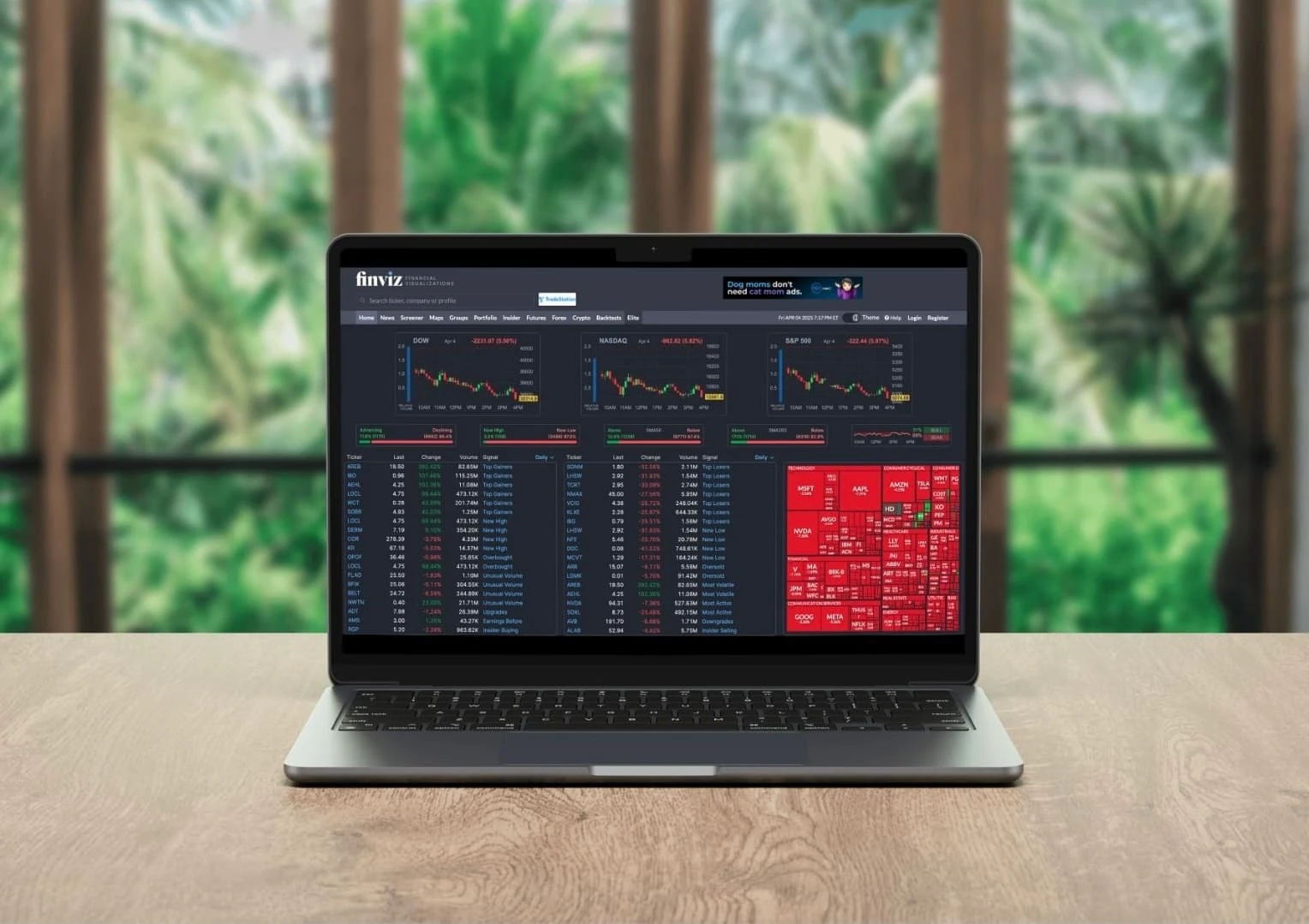

Use free tools like Finviz for quick stock screeners and combine that with visual chart platforms. You can also review pre-market data and the U.S. stock market today trends to align your analysis with broader market sentiment.

Over time, you'll start to build a personal archive of chart patterns, screenshots, and notes. This self-created library is one of the best stock investment guides you'll ever have—because it's based on your own learning and perspective.

3. Midday Check-In: Real-Time Stock Trading Awareness

Midday is ideal for reassessing your thesis. Has the market respected your support/resistance lines? Are your setups still valid based on intraday trends? Stock trading is about adapting, not predicting.

Whether you're into options trading, stock market options trading, or day trading common equities, it's important to adjust your bias if the market gives you new information.

Even a quick 5-minute check on your charts can help you stay aligned with your morning technical analysis. This can be the difference between reacting emotionally and acting with intention.

Don't Force Trades

Sometimes the best trade is no trade. Midday lulls are often full of fakeouts and low volume traps. Practicing restraint and waiting for confirmed chart patterns—like a breakout retest—makes a huge difference in long-term performance.

If you're new to this, consider using a stock trading simulator during these hours to practice setups without real risk. It's a smart way to build confidence and rhythm.

4. End-of-Day Review: Recap & Reinforce Chart Pattern Knowledge

At the end of your trading day, spend time reviewing the patterns that played out versus what you anticipated. This is where the real learning happens.

Log your wins and losses in a journal. Screenshot your stock market chart patterns and write a sentence or two about what worked and what didn't. Over time, you'll notice trends in your analysis accuracy and emotional decision-making.

Use resources like Practical Technical Analysis or revisit your daily notes and trading logs to reinforce learning. The goal here isn't perfection—it's pattern recognition and personal growth.

Build a Self-Guided System

This review process eventually becomes your own version of evidence-based technical analysis. You'll start seeing the market more clearly, not because you're predicting the future, but because you're practicing pattern recognition and journaling your thoughts consistently.

For newer traders, this is also a great moment to go back and review any trade simulations or test setups. The best routines always include reflection time.

5. Final Notes: Evolve Your Routine with the Market

The stock market isn't static, and your routine shouldn't be either. As you grow, you'll find new tools, strategies, or styles of trading that resonate with you. Maybe you transition from swing trading to day trading or begin exploring more advanced types of trading in the stock market like options strategies.

Stay curious and always return to the fundamentals. Whether you're learning how to trade stocks as a beginner or exploring advanced technical analysis trading methods, the foundation is always built on consistent observation, note-taking, and pattern recognition.

And remember, even seasoned traders continue learning. If you're ever unsure, review educational materials like the Stock Investment Guide PDF or join trading communities that focus on shared learning without hype.

Make It Work for You

The most effective stock market trading routine is the one that you can stick to—consistently and confidently. Whether you're trading with real money or using a simulator, showing up daily to analyze, reflect, and learn is what compounds over time.

So build your rhythm, stay disciplined, and make it personal. Technical analysis isn't just a skill—it's a mindset.